VAT - Partial Exemption Adjustment

A VAT registered entity that is making a mixture of taxable and exempt sales (Supplies) can usually only recover input tax on expenditure attributable to taxable supplies. Where a residual amount of input tax remains after directly attributing those amounts of input tax that can be related to either taxable or exempt supplies, it may be apportioned to allow for some recovery. The rules for apportionment are complex so it is recommended appropriate advice is sought from an advisor.

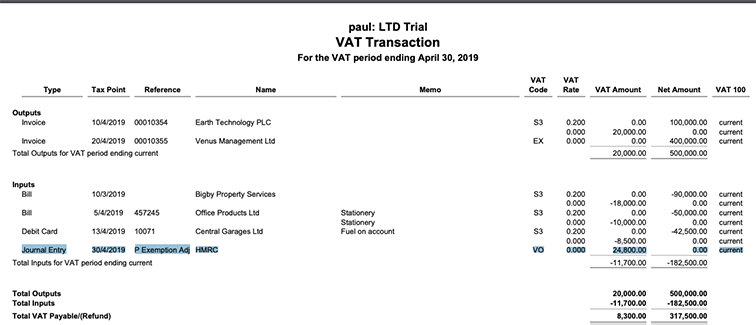

An example situation is as shown below together with a VAT journal showing how an appropriate adjustment to the VAT return can be made.

| Value excluding VAT | Output VAT | Input VAT | |

|---|---|---|---|

| £ | £ | £ | |

| Taxable Supplies | 100,000 | 20,000 | - |

| Exempt Supplies | 400,000 | 0 | - |

| All Supplies | 500,000 | 20,000 | - |

| Attributable to taxable supplies | 50,000 | - | (10,000) |

| Attributable to exempt supplies | 90,000 | - | (18,000) |

| Residual Input VAT | 42,500 | - | (8,500) |

| All Expenses | 182,500 | - | (36,500) |

| Partial Exemption Adjustments | |||

| for exempt supplies | - | - | 18,000 |

| for residual apportionment | - | - | 6,800 |

| Total Partial Exemption Adjustment | - | - | 24,800 |

| Final Input Tax | - | - | (11,700) |

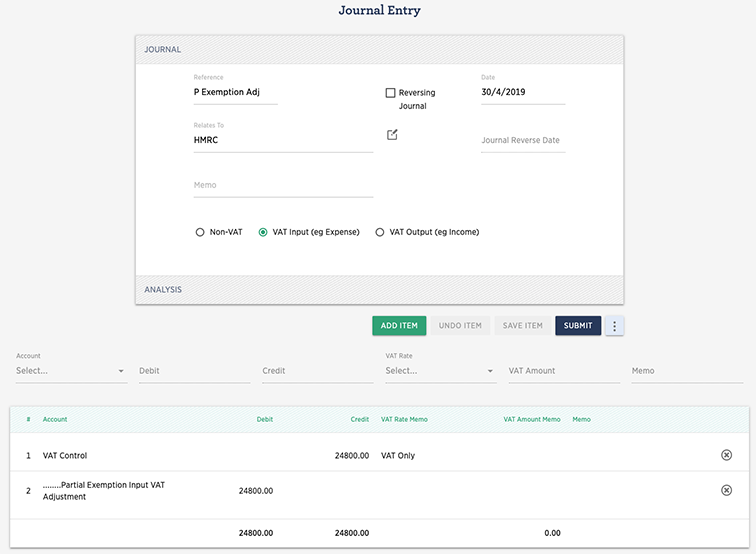

Journal to record Partial Exemption Adjustment

Create a VAT journal configured as in the example below.

Note that the VAT Input (eg Expense) button is selected and that one side of the journal is posted to the VAT control account as a credit and the other side to a suitable expense account as a debit.

The impact on the VAT return

The journal will adjust the input tax recoverable down by the adjustment amount but leaving the values un-changed as shown in the VAT transaction report below.