Setting up a Limited Company

Limited Companies have shareholders and are managed by directors. The company name ends in either Limited, Ltd. or PLC.

The process of setting up a limited liability company is launched from the Add menu.

Add - Limited Company

A screen form with five tabs is displayed. To move between the tabs click on a tab directly.

This guide addresses each tab as follows: -

- Business details tab

- Trading details tab

- Accounting options tab

- Optional features tab

- Billing, concessions and usage tab

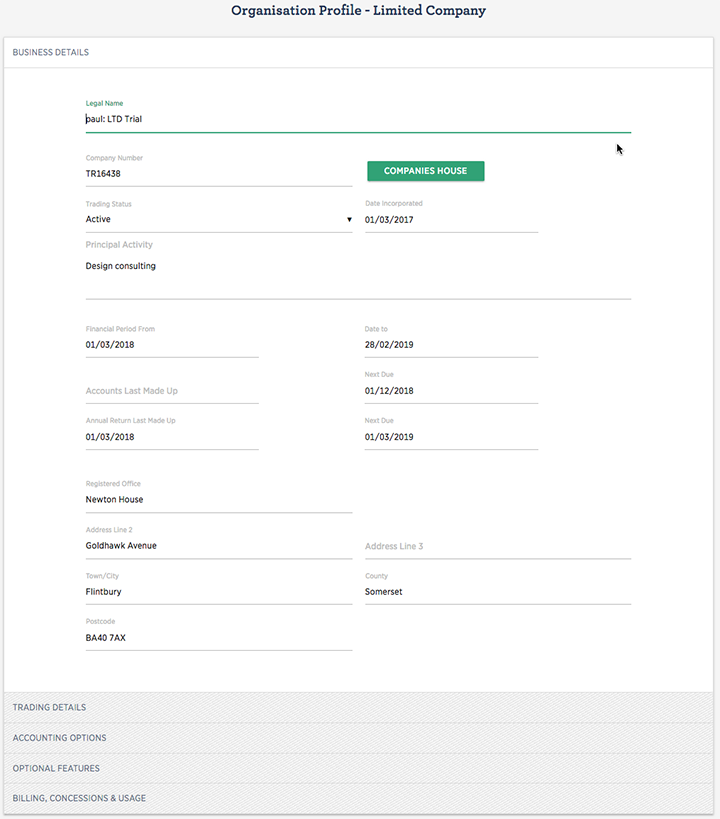

Business Details Tab

Enter the Company Number that appears on the certificate of incorporation issued by The Registrar of Companies. This is a mandatory field and once a valid number has been entered and stored the COMPANIES HOUSE button will access and display certain information stored by companies house and the relevant fields on the profile can be updated directly.

The legal name is entered and the Trading Status is usually selected from the drop-down as Active, however a business may be dormant, bankrupt or dissolved, and the historic records stored. Principal Activity is taken to mean the industry sectors or classes of business in which the company operates. This may also be subsequently be updated from Companies House data.

Enter the date incorporated that also appears on the certificate of incorporation and the tab also requests the dates of your current trading financial year. In this example, the current financial year commenced on 1st March 2018 and will end on 28th Feb.2019. Note that periods of more or less than 12 months can be entered.

The 'Accounts Last Made Up' and 'Annual Return Last Made Up' dates may be left blank in the first instance and subsequently populated from the COMPANIES HOUSE once the initial data has been submitted and stored. In any event the dates will be populated and updated by an overnight batch run.

Enter the registered office details.

Trading Details Tab

The next tab asks for details of the Trading Address. Note that the tab has a short cut to accept the registered office address as the trading address if they are the same. The Country field has the impact that where it is the same as a Customers country then the country address line on sales invoices and credit notes is suppressed as unnecessary.

If entered phone numbers, web address and email address will also appear on sales invoices and credit notes.

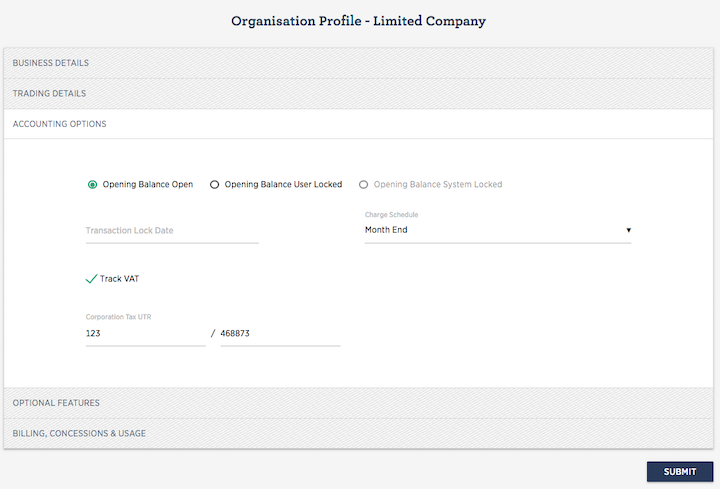

Accounting Options Tab

On the Accounting Options tab select the appropriate Accounts Template for your business. You may add, amend and delete accounts at a later date if necessary.

The Opening Balance Lock State is available for the user to ensure that once opening balances have been entered, they are not inadvertently altered. The user may check the User Locked box to stop any changes being made with the Opening balances menu The closed state may also be reversed by rechecking the Open box. The lock state will be automatically set to 'System Locked' once a Year End Close has been performed. Note that this is a permanent locked state and the opening balances menu option is permanently disabled.

Transaction Lock Date allows a user to set a date that will prevent a transaction dated before the lock date being entered. This could be used to control accounting periods other than a full year and is usually used in conjunction with an accounting advisor. If the date set is earlier than a closed year-end date the lock date will be ignored.

Charge Schedule, if you wish to run monthly routines to keep your depreciation and lease accounts regularly up to date, select a Monthly charge schedule. Annual will mean that the routine will only be run at the end of your year. Manual means that you or your advisor will have to provide the appropriate data manually.

If the business is registered for VAT then tick the Track VAT box. Further VAT details will subsequently need to be added via the VAT menu that will display when the profile has been submitted. A Corporation Tax UTR may be stored to appear on certain relevant listings that may be helpful to your advisor.

Click link for more on VAT - Setting up and Configuration

Complete the tab by entering the details of an initial bank account. This may be edited later or additional accounts? added. Note that this account can be displayed on the remittance advice attached to sales invoices; this again can be changed later. Also entering an opening balance can be done now or later if preferred.

Note that once a company has been set up this tab is simplified, with Accounts template and Bank account details not displayed.

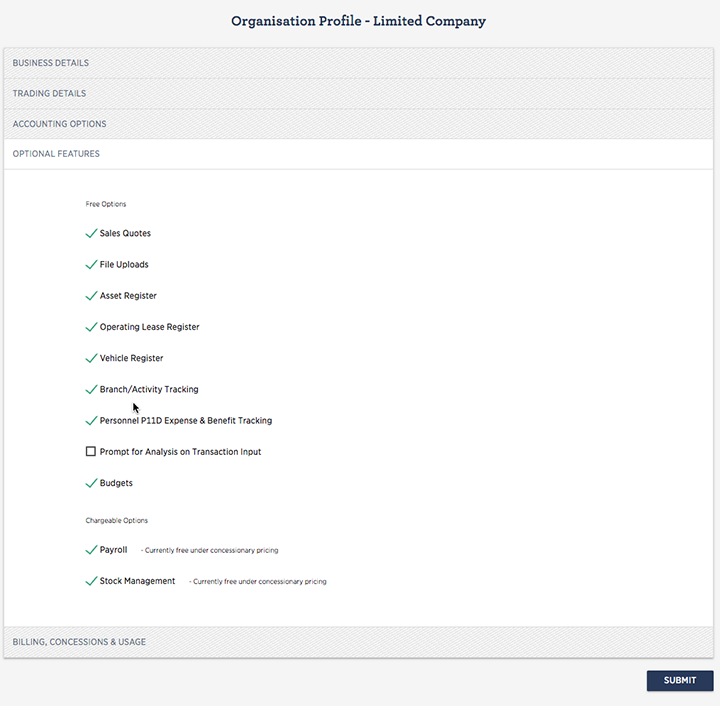

Optional Features Tab

The Optional Features tab allows the user so determine what additional features are required. Tick a box to make the feature available.

Note that Stock and Payroll menus will appear in the main menu if these options are selected.

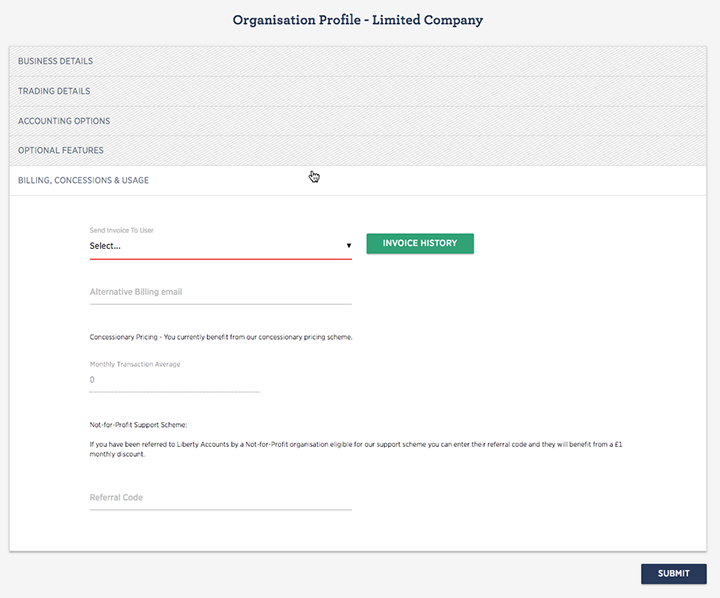

Billing, Concessions and Usage Tab

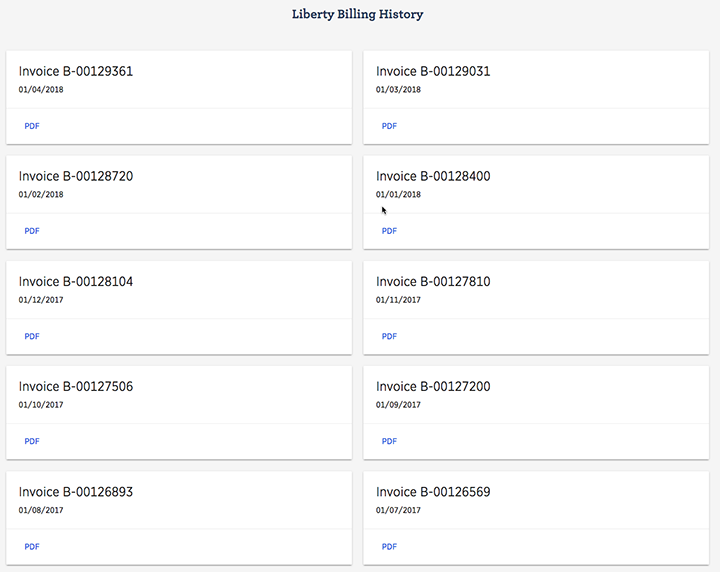

Where appropriate, a user name is selected to send the sales invoice for the Liberty Accounts service. The history of invoices sent to the entity is available from the INVOICE HISTORY button.

The Alternative Billing Email address allows a direct user ,not via a Liberty Accounts partner, to specify a different email address for the monthly invoice from Liberty Accounts to the one specified by the primary user in their user profile. For example you may wish the invoice to go directly to your bookkeeper.

Average monthly number of transactions posted is displayed as a measure of system usage.

A concession exists to allow Not-for-Profit entities to benefit from a referrals scheme.

Click the SUBMIT button to save all selections.