Making Tax Digital (MTD) Authorisation Process

What is needed?

Firstly the VAT details and VAT scheme for the organisation will already have been or will need to be configured on the Configure VAT screen.

HMRC - Configure VAT Scheme

Once done, granting permission for Liberty Accounts to file VAT under MTD to HMRC will require the following:

- Government Gateway ID

- Government Gateway password

If you have not already done so, register with HMRC gateway and obtain an ID and password. Use the following link. www.gateway.gov.uk

Granting MTD Authorisation for VAT

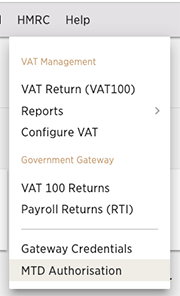

Navigate to the MTD Authorisation screen from the HMRC menu.

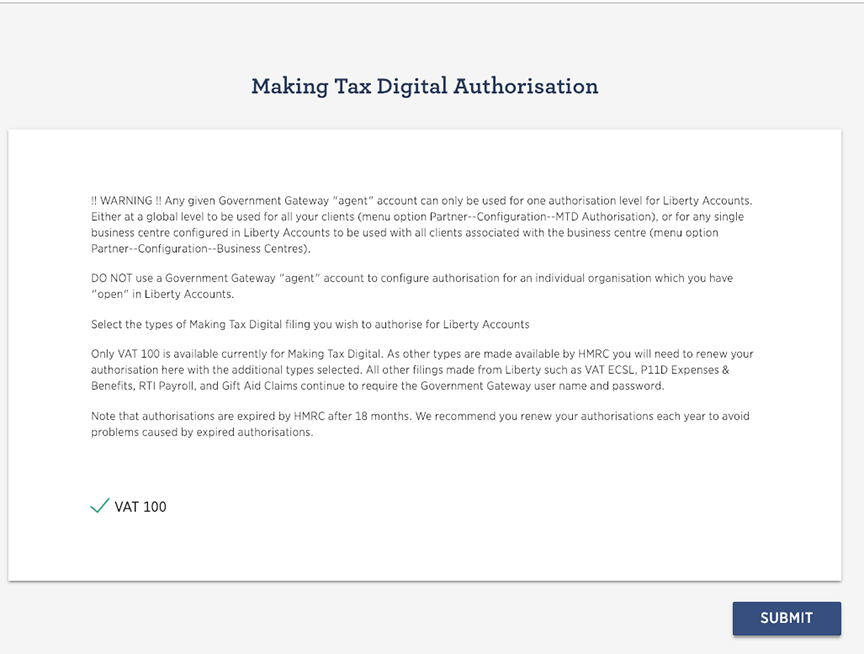

On the screen dialogue please note the comments particularly if you are acting as a recognised agent. Please also note the 18 month validity window.

When ready tick VAT100 and SUBMIT

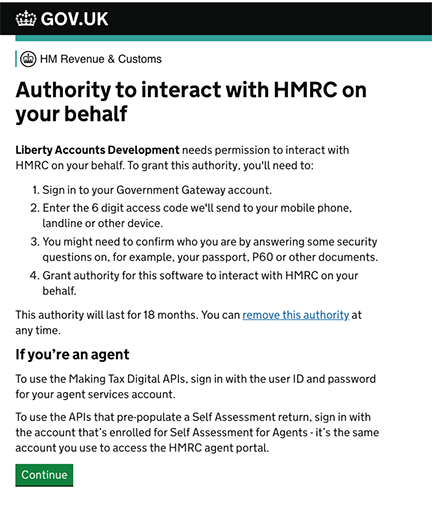

The user is then re-directed to an HMRC screen that describes the authorisation that is to be granted.

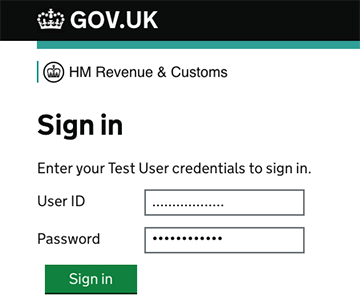

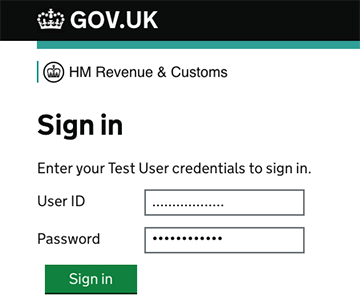

To proceed click CONTINUE and a gateway sign-in screen is presented. Enter gateway credentials and click SIGN IN

An HMRC dialogue is presented where the user grants authority. Click the GRANT AUTHORITY button.

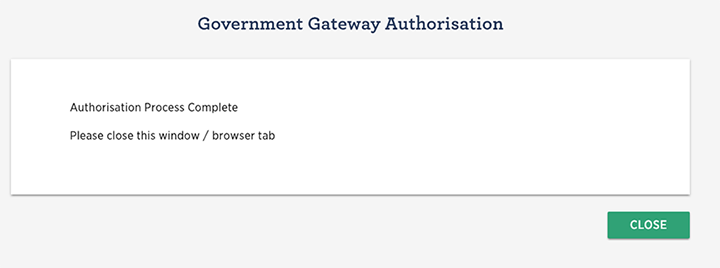

Liberty Accounts then presents a confirmation screen.

Confirmation that a VAT return has been filed using MTD

VAT and VAT filing is managed in the usual way. Once a VAT return has been ACCEPTED filing automatically takes place using the MTD authorisation.

The history of filed VAT returns can be viewed from the VAT 100 Returns List.

HMRC - VAT100 Returns

Previous VAT returns are displayed and those filed under MTD are shown with the Status column as "Filed MTD". Click the Action Menu and Download JSON to view the file of information as sent to HMRC. To see and print a hard copy of the VAT 100 form click the printer icon.