Payroll - Employment Allowance

From 6th April 2016 employers can claim the Employment Allowance and reduce their employer Class 1 National Insurance contributions (NICs) by up to, currently, £4,000 each tax year. Most businesses and charities that pay employer Class1 NICs on employers or directors earning are entitled to the allowance.

We recommend you take appropriate professional advice to ensure your business is eligible to receive employment allowance Liberty Accounts has, for businesses confirming eligibility, an automated procedure to handle Employment Allowance.

This guide addresses the following:

- How is employment allowance claimed?

- Setting up to handle Employment Allowance

- Letting HMRC know you are claiming Employment Allowance

- Where is the Employment Allowance recorded

How is employment allowance claimed?

Employment Allowance is claimed by setting a flag on an EPS Employer Payment Summary (EPS). Then simply reduce your employer Class 1 NICs payment by an amount of Employment Allowance equal to your employer Class1 NICs due up to the current maximum.

Setting up to handle Employment Allowance

From the Payroll menu navigate to PAYE Settings.

Payroll - Configure Payroll - PAYE Settings

Tick the Claim Employment Allowance box and where part of the current employment allowance has been already claimed in a another payroll system, enter that amount in the Allowance Already Claimed field. See below for another action that will be required. Click SUBMIT to confirm. Employment Allowance will now be recorded automatically for each payroll run in turn until the maximum has been claimed.

Letting HMRC know you are claiming Employment Allowance

Once you have set the Claim Employment Allowance box (above) you must confirm to HMRC that you are claiming Employment Allowance by submitting an EPS (Employer Payment Summary). It is recommended that this done after the first FPS has been filed after setting the allowance box.

HMRC - Payroll(RTI) - EPS - click the + symbol and select EPS

Confirm the sender classification and click SUBMIT.

From the RTI Employer Payment Summary screen click SEND to submit the EPS filing. Follow the process as normal.

Once submitted it is not necessary to send a EPS again for Employment Allowance purposes unless it is to signify that the business is no longer eligible to claim Employment Allowance. In which case un-tick the Claim Employment Allowance box and submit a new EPS.

Where is the Employment Allowance Recorded?

The amount of employment allowance is calculated when each payroll run is closed and accumulated up to the current maximum.

The amount of the claim is posted to Employment Allowance Recovered account as a reduction in expenses and as a reduction in payroll liabilities in an account called Employment Allowance.

Simply pay the amount of PAYE and NIC deductions (including the Employment Allowance) by the 19th of the next month as normal. The Payroll Run Summary Report provides the detail on a payroll-by-payroll basis.

Payroll - Reports - Payroll Run Summary

The amount of the employment allowance to date can be inspected on the Employment Allowance account under payroll liabilities.

Accounts -Other Accounts - Liabilities - Employment Allowance

Note at the end of payroll year, when the year is closed the balance on this account will be reset to zero for the new tax year.

Where part of the current employment allowance has been already claimed in a another payroll system

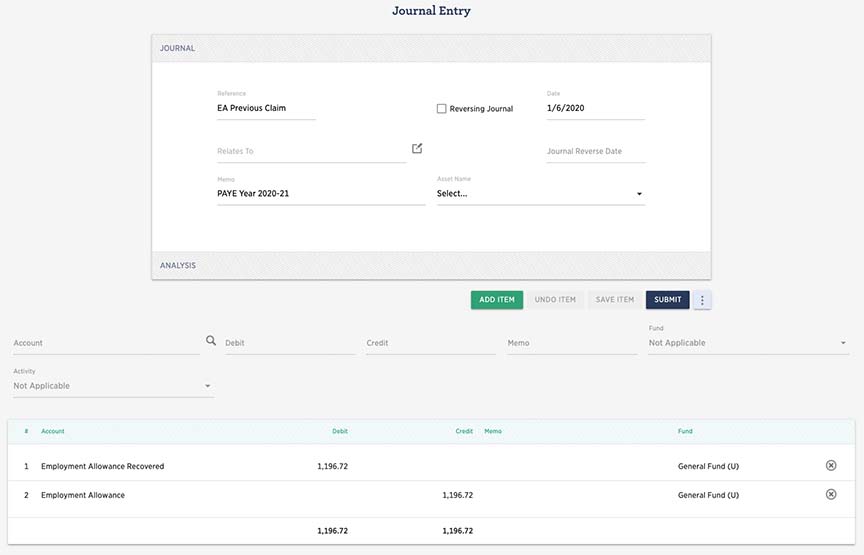

Having entered that amount of the Employment Allowance that has already been claimed on the PAYE Setting screen it is also necessary to post a Journal Entry on the system dated after the last payroll run on the old system but before the first payroll run on Liberty Accounts.

To enter a Journal Entry navigate to the Control menu

Control - Add Journal

In the screen enter the value of the prior claim with a Debit to Employment Allowance Recovered (an Expense Account) and Credit to Employment Allowance (a Current Liability Account). See the example in the image.