Payroll - Pension Schemes

Any pension schemes (including those resulting from Government workplace pension/auto-enrolment initiatives) that are available to employees may be set up so that any contributions to the schemes from either the employee or employer are calculated and recorded and included in payslips.

We recommend you take appropriate professional advice to fully understand the nature of any pension scheme and any obligations with respect to National Insurance Charges and Auto-enrolment.

In most cases a pension scheme will require the employer to work with a pension provider.

Auto-enrolment

It is recommended that auto-enrolment processes and staging dates for your organisation be reviewed on the Pensions Regulator website: -

A tool is provided for an employer to specifically identify the actual date that, under law, they must implement a work-based pension scheme for those employees that qualify.

In essence for those employers with more than 250 employees at 1/04/2012 then worked based pension schemes are implemented between Oct. 2012 and Feb. 2014. For those with less than 249 but more than 50 between April 2014 and April 2015; for those with less than 50 on 1/04/2012 then between June 2015 and April 2017. For New Employers after 1/04/2012 the stage date will be between May 2017 and Feb. 2018. To repeat, for your precise date refer to the Pensions Regulator.

Auto-enrolment means that every employer must automatically enrol workers into a workplace pension scheme if they:

- are aged between 22 and State Pension age.

- earn more than £10,000pa

- work in the UK

The law says a minimum percentage of 'qualifying earnings' must be paid into a workplace pension scheme. Qualifying earnings are either:

- the amount earned before tax between £5,876 and £45,000 (for 2017-18 tax year)

- the entire salary or wages before tax.

As the employer you must make this decision.

For defined contribution schemes (likely to be the majority) the minimum contribution rates that will be increased in April 2018 and April 2019. The minimum Employee Contribution is currently 1.0% rising to 3.0% from April 2018. The minimum employer rate is 1% rising to 2% from April 2018. Both employee and employer may contribute more than the legal minimum.

Employers are required to assess their employees against the auto-enrolment criteria to determine their status. The assessments must be done at various times and the system has a convenient process to deal to make these assessments.

Setting up a Pension Scheme

Pension Schemes are set up via the Configure Payroll menu.

Payroll - Configure Payroll - Pension Schemes

A pension scheme maintenance screen is drawn where details of the scheme and how it is to operate are set. Default contributions are also defined as well as relevant recording keeping accounts.

Deduction Regime's in the pensions industry refer to schemes as either 'Net Pay' or 'Relief at Source'.

Note that not all pensions schemes will qualify as Auto-enrolment schemes so it is important that users make the necessary enquiries of their potential scheme provider.

Net pay vs Relief at Source

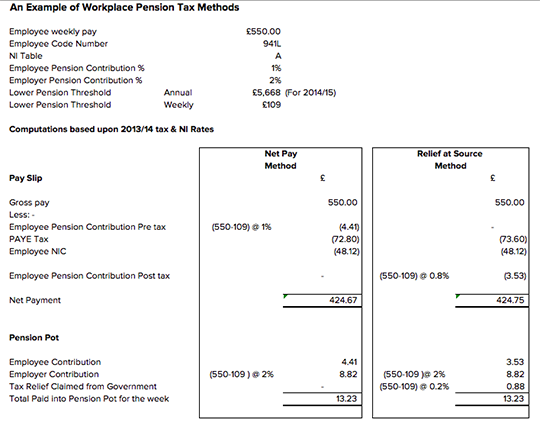

For workplace pensions (as well as some other schemes) basic tax is added to the savers pension pot. This can be provided in one of two ways.

- Net pay

- The employer takes the employees contribution and tax relief element from their pay before it is taxed. This means full tax relief is given immediately. The employer pays over both the employees and employers contributions to the pension pot, which therefore includes the tax relief element. The employees deduction on their payslip is their contribution plus tax relief added together.

- Relief at Source

- The employer takes the employees contribution after deducting tax and national insurance from gross pay. The pension provider will then add tax to the pension pot. The employees deduction on their payslip is their contribution and does not include any tax relief. The pension scheme provider will confirm which method needs to be used. For example a NEST scheme uses the 'Relief at Source' method.

Either method may be implemented in Liberty Accounts for a particular scheme by following the guidance in the Setting up a Pension Scheme section above.

A worked example of both methods is shown below.

Your pension scheme provider will tell you which type of scheme you are using. It is important that this is set correctly.

Note NEST schemes use the 'Relief at Source' method.

For auto-enrolment schemes you also have the option to restrict deductions to the auto-enrolment thresholds. Your use of this option will depend on the agreement you have with your employees.