VAT - Retail Schemes

A number of VAT on takings (Retail schemes) are available for retailers to use to calculate output tax; which is the most appropriate scheme depends on a number of factors and consulting an advisor is very strongly recommended.

The start point for the schemes is the notion of Gross takings which is the VAT inclusive sales value. The VAT fraction is then applied to find the VAT element of the price (1/6 for standard rates sales charged at 20%; 1/21 for reduced-rated sales charged at 5%.

| Gross Takings | VAT Fraction | Output VAT Due | |

|---|---|---|---|

| Standard Rated | £120,000 | 1/6 | £20,000 |

| Reduced Rated | £52,500 | 1/21 | £2,500 |

| Zero Rated | £20,000 | - | - |

| All Supplies | £192,500 | - | £22,500 |

Retail Schemes available

- Point of Sale

- Direct Calculation 1

- Direct Calculation 2

- Apportionment 1

- Apportionment 2

It is not the role of this guide to explain these schemes in detail or give guidance as the the most appropriate scheme to use, but users of the system can apply these schemes as follows:

Point of Sale

Simply use the Cash/Card takings process as normal

Other Schemes

Gross takings will be posted to the system using the Cash/Card takings process but off-line calculations will be required to find an adjusting amount of output tax. That adjustment is then posted using a VAT Journal (see below)

for example if the Apportionment 1 scheme

| Gross takings and VAT as posted using cash/card takings | |||

|---|---|---|---|

| Gross takings | Output tax | Sales | |

| Standard rate | £156,000 | £26,000 | £130,000 |

| Reduced rate | £13,650 | £650 | £13,000 |

| Zero rate | £10,000 | - | £10,000 |

| All supplies | £179,650 | £26,650 | £153,000 |

| Applying direct purchase proportion (calculated off line) | |||

| % proportion | VAT Fraction | Output tax | |

| Standard rate | 80% | 179,650x80x1/6 | £23,953.33 |

| Reduced rate | 15% | 179,650x15x1/21 | £1,283.21 |

| Zero rate | 5% | - | - |

| All supplies | - | - | £25,236.54 |

| - | - | - | (£1,413.46) |

Note the Transaction by VAT code report can provide some of the necessary background information for the off-line calculations.

HMRC - VAT Reports - Transactions by VAT Code

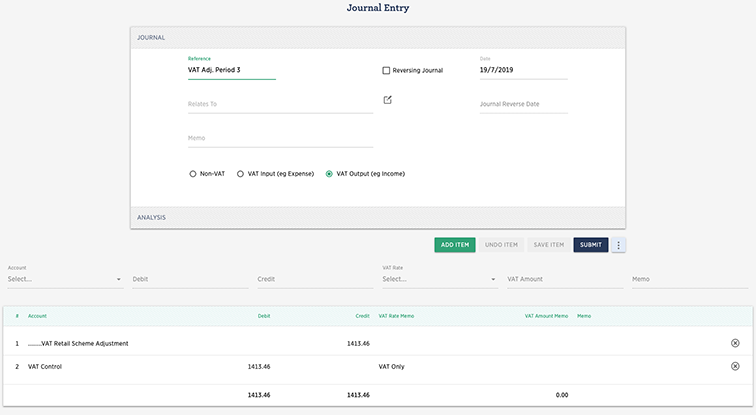

Journal to record Retail Scheme Adjustment

Create a VAT journal configured as in the example below.

Note that the VAT Output (eg Income) button is selected and that one side of the journal is posted to the VAT control account and the other side to a suitable adjustment account.