Opening Balances Process

Correct opening balances are the key to bookkeeping activities. If you do not enter them accurately your accounts will be wrong (although adjustments can be made subsequently, it is recommended that the opening balances should be correct to begin with). Entering opening balances, although not as straightforward as most other processes, can be achieved by following the instructions accurately. Ensure that you have all the relevant information to hand for each stage of the procedure before starting.

This guide addresses the following topics: -

- What are Opening Balances?

- What is a trial balance?

- Opening Balances Procedure in Summary

- The Opening Balances Process

- Define Branches and Activities (if required)

- Opening Balances for Bank Accounts

- Opening Balances for Customers

- Opening Balances for Suppliers

- Opening Balances of Tangible Fixed Assets

- Opening Balances for Other Assets

- Opening Balances for Liabilities

- Opening Balances for Income and Expenditure

- Completing the Opening Balances Process

What are Opening Balances?

Opening balances represent a snap shot of the financial state of your entity at the date of starting with the system. The following types of data are usually needed: -

- Customer transactions that have not been completed such as invoices that have been issued but not yet paid by the client/

- Supplier transactions that have not been completed, Invoices for goods or services received but not yet paid, tax and VAT payments still to be made to the authorities.

- Other information such as the values of assets, capital, stock or hire purchase agreements. This is known as a nominal trial balance.

- Bank account balances.

The opening balances that you input must represent the financial position of your entity on the day you start entering live transactions. This usually means entering a trial balance dated the day before the first day of the first accounting period. If this is a recently new activity then there may only a little data necessary to be input, such as opening bank balances and any start up expenditure. However if you are transferring a more established entity from another system it will be necessary to collect the information from that system.

Return to the list of topics in this user guideWhat is a trial balance?

A trial balance is a list of all the accounts , chart of accounts, at a given date, together with the value shown either as a debit or credit balance. In the double entry bookkeeping system, if correct, the sum of all debit balances equals the sum of all credit balances.

| Account | Debit | Credit |

|---|---|---|

| Capital | 3000 | |

| Borrowing | 5000 | |

| Rent | 200 | |

| Equipment | 1500 | |

| Wages | 100 | |

| Materials | ||

| Sales | 450 | |

| Bank Account | 6150 | |

| TOTAL | 8450 | 8450 |

For a bank account in which you may have money, the statement will show this as a credit balance; you are in credit with the bank. However in a trial balance because the money in the bank is an asset, something you own, it is shown as a debit. An overdraft or bank loan would be shown as a credit. All assets are shown as debits and all liabilities are shown as credits.

Return to the list of topics in this user guideOperating Balances Procedure in Summary

It is strongly recommend that advice be sought from your accountant or advisor if you are unsure about setting up your opening balances.

- Set up and enter balances for the business bank accounts

- Set up details of the Charities funds and the opening balances

- Set up details of any Activities

- If you have customers and suppliers any outstanding balances need to be entered first

- If you are using fixed assets in your business and recording them as part of your business, items such as equipment, computers, vehicles etc. We would advise details of these items entered in the asset ledger

- Enter opening balances for the rest of your accounts (chart of accounts)

- This will be split up into four smaller pieces of input: -

- Assets

- Liabilities

- Income (If you are entering opening balances mid-way through a year)

- Expenses (If you are entering opening balances mid-way through a year)

- Print your trial balance and verify all figures. Suspense account should be zero

The Opening Balance Process

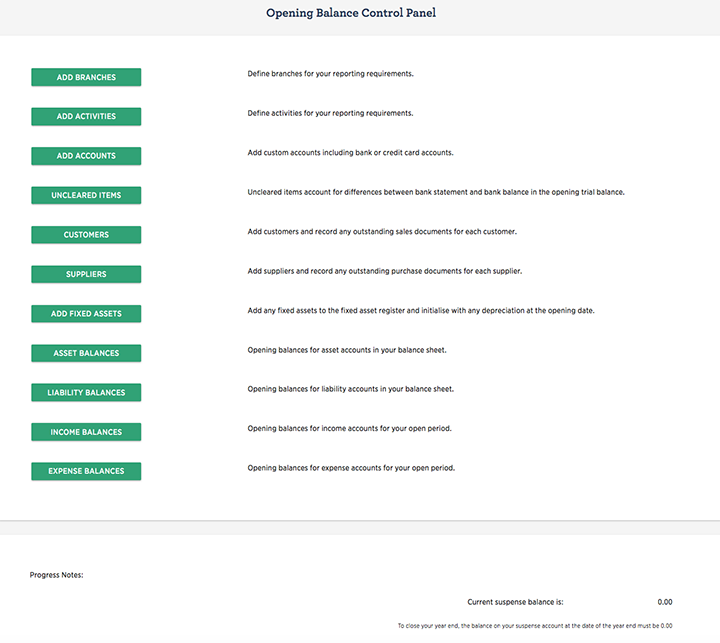

The Opening balance processes are grouped together under the Entity Name menu in an Opening Balance Control Panel.

Control - Opening Balances

The panel has input processes for each major element of the opening balance. Progress notes indicate any balance on the suspense account; it should be zero when all opening balances have been input.

Return to the list of topics in this user guideDefine Branches and Activities

Income and expenditure transactions can be analysed to Branches and/or Activities. Both are very useful for enhanced business intelligence and reporting.

Control - Opening Balances - Add Branches

Control - Opening Balances - Add Activities

More information from Setting up and using Branches and Activities

Return to the list of topics in this user guideOpening Balances for Bank Accounts

At least one bank account is required for the system to operate. A bank account was probably created at the time of setting up the entity, but if not, then an account needs to be set up at this stage.

Additional bank and credit accounts that have opening balances will also need to be created using the process described below. Information needed: -

- Name and details of Bank account

- Bank Statement dated close as possible to your opening balance date

- Details of any un-cleared transactions

Un-cleared items are transactions that have already been recorded in the accounting system; written a cheque to a supplier or a cheque, or other delayed payment, received from a customer, but they have not yet appeared on your bank statement.

Control - Opening Balances - Add Accounts

In the Account Maintenance screen, enter details: -

- Active

- Allows account to be de-activated, in this case leave ticked as active

- Easy View

- If ticked, the account balance is displayed on the business home page

- Account Name

- Enter name such as 'HSBC Current'

- Description

- A text description

- Account Type

- Select account type 'Current Assets - Bank Account'

- Sub Account

- If the account is a sub account of another, select it. In this case leave blank

- Cross reference

- Leave blank, this is used by your advisor in preparing reports

- Opening Balance

- Enter the balance on your bank statement

- Date

- Bank statement date

- Bank import Format

- Select a format to allow statement uploads

- Account number

- Bank account number

- Sort Code

- Bank Sort Code

- IAN

- Enter if required to appear on remittance advices

- SWIFT Code

- Enter if required to appear on remittance advices

Click SUBMIT when complete.

More information from Account Details Maintenance

Use the un-cleared transactions screen to enter those items that make up the difference between the bank statement and the bank balance in the opening trial balance.

Control - Opening Balances - Uncleared Items - Edit relevant account

Review and check the data input by inspecting the bank account balance. Now confirm that the balance on the account equates to the amount in the trial balance.

Accounts - Bank/Credit Accounts - click this account

Make adjustments if necessary. Repeat the above for all bank accounts you wish to set up at this point.

More information from Uncleared Items - Bank Accounts

Return to the list of topics in this user guideOpening Balances for Customers

The Information needed will include the name and details of customers, plus details of the invoices and credit notes that are outstanding; i.e. that make up the balance of the trade debtors.

Setting up Customers for opening balances is done from the Customers element of the opening balances panel.

Control - Opening Balances - Customers - click red + symbol then Cus icon to Add Customer

The Customer Maintenance Screen is presented More information on the screen is available from Customer Details

Click SUBMIT when complete the screen redraws to list the customer. An Action Menu adjacent to the Customer name has an Opening Balance Items command for a screen to enter opening documents.

To enter opening documents obtain data from your existing accounting system or your advisor. The data needed for EACH Invoice or Credit Note raised but not yet paid by your customer:is as follows: -

If Non VAT Registered or Registered for VAT using the Standard Scheme

- Invoice or Credit Note Reference

- Gross value of Invoice/Credit Note

- Date the document was raised

If Registered for VAT using the Cash Accounting Scheme

- Invoice or Credit Note Reference

- Net value of Invoice/Credit Note

- VAT element of the document

- Date the document was raised

If you are entering opening balances for month one of the new financial year we recommend that opening balances are dated the last day of the previous financial year or the actual invoice date. If you use the actual invoice date, the debtor ageing reports will be correct. If you are entering opening balances mid-way through a year, we recommend that you use either the actual invoice date or the last day of the previous accounting period. For example, if the financial year started January 2018, but the first processing month on the system was August 2018, then either use the original invoice date (and maintain correct debtor ageing reports) or 31st July 2018.

Click ADD ITEM to allow data to be entered and from the Document Type dropdown select either an Invoice or Credit Note.

See Customer Opening Balance Documents for more help.

When all invoices and credit notes have been recorded check that each customers balance equals the amount shown in the trial balance, make adjustments if necessary.

Note: - It is also possible to load basic customer information as well as opening balance information using a CSV type file in an upload process. Full details are available in the Customer and Supplier Upload Process user guides.

- Uploading Customers Using csv Files

- Uploading Suppliers Using csv Files

- Uploading Invoices Using csv Files

- Uploading Bills Using csv Files

Repeat for all your Customers or if you prefer just those for which there are balances in the opening trial balance and add others later.

It is possible to amend a customer opening balance using the route described above provided that no receipt or credit note consumption has been allocated against the opening balance item. Likewise if a year-end closure has taken place the opening balances cannot be amended. A warning message will display if a change is attempted.

Opening Balances for Suppliers

Opening balances are set up in a very similar manner to Customer opening balances described above.

The Information needed will include the name and details of suppliers, plus details of the bills and credit notes that are outstanding; i.e. that make up the balance of the trade creditors Before opening balances can be entered details of each supplier for which there is an opening balance must be entered.

To enter opening documents obtain data from your existing accounting system or your advisor. The data needed for EACH Bill or Credit Note raised but not yet paid by your customer:is as follows: -

If Non VAT Registered or Registered for VAT using the Standard Scheme

- Bill or Credit Note Reference

- Gross value of Bill/Credit Note

- Date the document was raised

If Registered for VAT using the Cash Accounting Scheme

- Bill or Credit Note Reference

- Net value of Bill/Credit Note

- VAT element of the document

- Date the document was raised

Opening Balances of Tangible Fixed Assets

If the business is using tangible fixed assets (Machinery, Computers, Vehicles etc.) then the trial balance will include amounts for the value of these assets. The value of these assets will have to be entered as opening balances for the original cost or valuation of the assets and the cumulative depreciation.

The input screen for Tangible Fixed Asset opening balances is accessed via the Tangible Fixed Assets element of the Opening Balance Control Panel

Control - Opening Balance - Add Fixed Assets

Fixed Assets may be allocated to Funds and/or Activities if required. It is recommended that data is entered for each individual asset; if this not possible then an aggregation may be used. Please consult your accountant or advisor if you are unsure.

Refer to Add Fixed Assets for more details.

Return to the list of topics in this user guideOpening Balances for Other Assets

The trial balance may well include items such as Stocks, Investments and other debtors, these are input via the Balance Sheet Assets Screen of the Opening Balance Control Panel.

Control - Opening Balance - Asset Balances

Obtain data from your existing accounting system or your advisor. For each asset account, other than Tangible Fixed Assets and Trade Debtor, the balance as at the opening balance date.

The Opening Balance Asset Screen follows a simple input routine. The screen will display all asset accounts that are currently available. If a required account is missing either add from the standard list or create a custom account.

Enter the Opening Balance Date and for each account that you have an opening balance enter the value in the Opening Balance column.

When all balances have been entered click on SUBMIT. Amendments may be made subsequently by returning to the Screen.

Return to the list of topics in this user guideOpening Balances for Liabilities

The trial balance may well include items such as borrowings, payroll deduction liabilities these are input via Balance Sheet Liabilities screen of the Opening Balance Control Panel.

Control - Opening Balance - Liability Balances

Obtain data from your existing accounting system or your advisor. For each liability account, other than Trade Creditors, the balance as at the opening balance date. The Opening Balance Liabilities Screen is similar to the Opening Balance Asset Screen and data is input in the same way as above.

Return to the list of topics in this user guideOpening Balances for Income and Expenditure

You may ignore this section if you are entering opening balances at the start of a new financial year and no profit and loss transactions have yet been incurred. If your start point for using the system is mid way through your financial year, than Profit and Loss account items (sales and expenses) will have been incurred and they will be part of the opening trial balance. The balance on any sales and expenses accounts at the date of entering the opening balance needs to be input in a similar way to assets and liabilities.

There are screens provided for this accessed as follows:

Control - Opening Balance - Income Balances

Control - Opening Balance - Expense Balance

Input data in the same way as described in the section on Opening Balances for Other Assets (above).

Return to the list of topics in this user guideCompleting the Opening Balances Process

Print out the Trial Balance Report. This is accessed via the Reports menu.

Reports - Trial Balance

Select the Opening balance date.

If all has gone well the balance on the Suspense Account will be zero. If not print out the trial balance report and carefully review and check each figure against your original input data or trial balance.

You will need to check that:

- Opening balances for all your nominal accounts from your full trial balance have been entered

- An opening balance has not been entered twice

- Balances have not been entered as debits when they should be credits and vice versa

Go back and make any necessary amendments and reprint trial balance report. Confirm that it is now correct.

Congratulations you have now completed your opening balance procedure.

Return to the list of topics in this user guide