Shares, Shareholders and Dividend Declarations in Limited Liability Companies

For limited liability companies dividends can be declared, dividend payments evaluated and tax vouchers prepared and printed from within the system. Details of share types, shares authorised and shares in issue together with company members (shareholders) are maintained to provide the base information for dealing with a dividend declaration. If uncertain about these matters the user is advised to consult a professional advisor.

In summary to manage the processes: -

- Enter the Company name, number and registered address is accurately held on the system.

- Check that a least one company officer has been set up.

- Enter accurate details of company members.

- Set up details of share types and record the authorised numbers.

- Record the details of the number of shares issued to individual members.

The items above are usually only infrequently updated.

To complete a dividend declaration.

- Enter details of the specific declaration.

- Inspect the dividend list and when content, distribute the dividend vouchers

- Pay the dividend in cash

Company Name, Number and Registered Address

This information will appear on the dividend tax voucher given to shareholders. It was entered when the entity was set up; it is maintained via the Organisation Profile menu.

Control - Organisation Profile - Inspect or amend the details on the Business Details tab as required

Company Officers

An officer?s name will appear on the dividend voucher. Company officers (Directors and/or Secretaries) are set up and maintained via the Officers/Employees menu.

Payroll (or People) - Manage Employees - EDit or Add Employee - Edit Posts Held

OR

Control - Shares and Dividends - Add Company Member

Where the member is also an Officer or Employee and the display names match, any changes will be reflected in the employee record. If a valid email address exists it is indicated. Tax vouchers may be emailed directly to the member from the dividend review screen (see below).

Setting up Share Types

Share types to be authorised and issued are entered using the Share Types menu. Select from: -

- Ordinary

- Preference

- Redeemable

- Redeemable Preference

Control - Shares and Dividends - Share Types

Enter the details including the nominal value of the shares. Enter as many types as necessary.

Authorise, Issue, Transfer or Cancel shares

Whilst it is no longer necessary to authorise shares prior to them being issued, for the time being the system system requires it. The number of authorised shares for each share type is entered in the Authorise Shares screen.

Control - Shares and Dividends - Authorise Shares

Select the relevant Share Type from the drop-down box. Confirm a Date and the number of Shares being authorised. Shares are issued to members in the Issue shares screen. Note that shares can only be issued once they have been authorised.

Control - Shares and Dividends - Issue Shares

The Share Type to issue is selected and the member to whom they are being issued is selected in the Issue To drop-down. Enter the Quantity to Issue. If the accounting entries for the subscription monies is required tick the 'Generating Accounting Entries' box and select a Bank account for the deposit. If not un-tick. SUBMIT to complete.

Note that shares may be transferred or cancelled using the appropriate menu items.

Control - Shares and Dividends - Transfer Shares

Control - Shares and Dividends - Cancel Shares

A summary of all share transactions can be viewed on the screen from the Share Summary.

Control - Shares and Dividends - Share Summary

A hard copy report of shares balances is available from the Reports menu.

Reports - Member Share Balance

Declaring a Dividend

A dividend is declared from Add Declaration.

Control - Shares and Dividends - Add Declaration

Important Note: Essentially dividends can only be paid from after tax profits, never losses. If you are at all uncertain as to the situation and the potential tax considerations you are strongly advised to seek professional advice before declaring and paying dividends.

The Dividend declaration screen is presented. The Dividend Type can be either an Interim or Final dividend. Only one Final dividend is allowed from a particular Financial Period. The Share Type will need to be selected. The particular declaration will only apply to this Share Type and its holders and for the Financial Period selected.

Set the Declaration Date. This date will represent the transaction date and is potentially important for taxation purposes. The Dividend needs to be entered as pence per share. So £0.50 per share is entered as 50; £2.50 per share is entered as 250. The dividend is computed as the number of shares held multiplied by the rate per share. Select the Approving Officer. This name will appear on the dividend tax voucher as the authorising officer.

The Approving User is the user making the declaration and in the Confirmation Tick Box the user is confirming that the transaction has been reviewed, is appropriate and any consequences have been considered. A SUBMIT button appears, click this to set the status of the declaration as pending, note at this stage the dividend has not been approved or the details posted.

A review screen is drawn that presents the details of the pending dividend declaration. In additional to the details, the financial consequences are shown in total as well as for the individual members.

Print Minute button will produce a PDF file of supporting minutes for the declaration. Although not necessary, the minutes pdf file may be stored on the system to be viewed from Saved Reports under the Reports menu by clicking the Save Minutes button. Individual Dividend vouchers can be displayed (as PDF files) by clicking the printer icon adjacent to a member. Although not necessary, each Voucher pdf file may also be stored on the system to be viewed from Saved Reports under the Reports menu by clicking Save Voucher on the Action Menu. Note, that until approved, all PDF files will be watermarked with ?Not Approved?.

To approve the declaration, click the APPROVE button. This action will: -

- Remove the watermark from printable files

- Redraw the review screen

- Present an email icon adjacent to a member to allow the dividend tax voucher to be emailed

- Post the accounting transactions

- Store the details of the declaration as Approved

Dividend Approval Minute

A dividend approval minute is prepared by the system for each dividend declaration. The context of the minute is related to the specific approval and no further adjustment is necessary. For an interim dividend declaration the minute is a Board Minute and for a final dividend declaration the minute is a Shareholders Resolution. It is recommended that after the approval of the declaration the minute is printed and stored appropriately.

Dividend Voucher

For each member (shareholder) benefiting from a dividend declaration a Dividend Voucher is prepared. The context is related to the specific approval and no further adjustment is necessary. The Voucher may be emailed directly to each member or printed as a hard copy and distributed.

Tax Credit

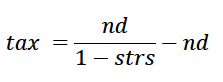

For dividend declarations up to 6th April 2016 the system maintains details of the Starting Tax Rate for Savings applicable to Tax Years ending on the 5th April. The tax credit that is calculated is dependant on the declaration date set when the dividend is declared and the tax year in which it falls. The calculation is:

Where 'tax' is the tax credit, 'nd' is the net dividend (as declared) and 'strs' is the starting tax rate for savings as stored by the system. The gross dividend is the sum of net dividend plus tax.

Accounting Entries

On approval of a declaration the system will post a journal entry as follows: -

Increase (credit) the Dividend Payable Account with the net dividend (Account type = Liability-Current)

Increase (debit) Distribution to Equity Shareholders with the net dividend (Account type = Shareholder Funds)

Note it is the users responsibility to arrange for the actual cash payments to members and record them.

Dividend Declaration History

The history, details and status of previous declarations are available from Dividend Declarations menu.

Control - Shares and Dividends - Dividend Declarations

The list of declarations may be filtered by Pending or Approved declarations.

Use the Action Menu for various relevant actions.

Reversing a Declaration

An un-approved declaration can be deleted simply be clicking the DELETE button on the from the Action Menu on the review screen.

A user with an appropriate user role can reverse an approved declaration. This is in two stages: - From the Batch Run History, Delete the appropriate declaration run.

Control - Batch Jobs - Batch Run History - Set the Batch Run Type to Dividend Approval

From the Action Menu Delete the required dividend approval

Return to the Dividend Declaration History screen (See above) and a Delete button will be visible from the Action Menu. Click this to reverse the declaration. Obviously reversing an approved declaration needs to be done from the basis of knowledge and understanding of the consequences. If you are in the slightest doubt please seek appropriate professional advice.