Payroll Cost Analysis

Payroll cost analysis is a powerful tool used to allocate payroll costs to Funds (Not for Profit Organisations only), Departments and/or Activities.

Cost analysis is managed at the three levels:-

- Organisation level

- Set on PAYE Settings, the specified analysis will apply to all employees on all payroll runs unless amended as below

- Employee level

- Set on Employee details, the specified analysis will apply to the particular employee for all payroll runs unless amended as below

- Payroll Run level

- Set on Quick Pay/Deductions, analysis will apply for a particular employee for that particular payroll run

Initiating Payroll Cost Analysis

Employee payroll costs can be analysed to Funds, Departments and/or Activities using a percentage for each allocation.

Funds, Departments and Activities need to exist before the analysis can be applied. If necessary navigate to the Operational Features Tab of the Organisation Profile to switch on Department and /or Activity analysis. Note Not-for-Profit organisations have Fund analysis activated by default.

For commercial organisations navigate to: -

Control - Departments & Activities

Add Departments/or Activities as required.

For Not-for-Profit organisations go to the Funds menu to Add Funds and

Control - Departments & Activities

Add Departments/or Activities as required.

Please note that where an organisation is claiming HMRC employment allowance allocation set on the PAYE settings record. As a capped benefit the Employment Allowance cannot be specific to any particular employee or particular payroll run it is not therefore included in the payroll costing allocation rules described below.

Using payroll Cost Analysis

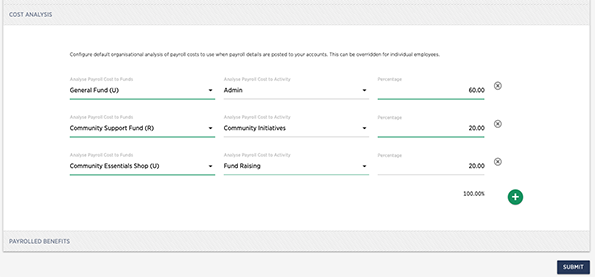

Navigate to Cost Analysis Tab under PAYE settings to set the organisation level allocations.

Payroll - Configure Payroll - Cost Analysis

Click on the green + symbol to enter a new allocation and select the analysis items from the Funds/Departments/Activities drop-down fields. Amend the % (percentage) field as required. Click the green + symbol again to other lines. Note the percentages must sum to 100%. Click SUBMIT to store.

Click on the adjacent  symbol

to permanently delete an allocation.

symbol

to permanently delete an allocation.

To set a specific cost analysis for an employee that will overwrite the organisation analysis, navigate to cost analysis on the Employee details record.

Personnel - Manage Employees - Employee Details - Cost Analysis

Set up in a similar way described above. Remember that this analysis will apply to each payroll run for this employee until changed or overwritten for a particular payroll run.

Changing the cost analysis for a specific payroll run for a specific employee

Use the Quick Pay/Deductions screen under the Payroll menu to enter a specific employee analysis for this payroll run. Click the blue COST ANALYSIS button to open up a screen where an analysis may be entered by clicking the green + symbol for as many times as required.

Computing the Cost Analysis

Where, for any particular employee there is a single pay element involved on the payroll, the system simply apples the set percentages to any Pay, Employers National Insurance and Pension.

In the case of multiple payments elements each, perhaps, with a different cost allocation the system will use pro-rate rules based upon Pay to allocated Employers National Insurance and Pension.

Recording the Cost Analysis

When a payroll run is finalised (closed) the system automatically posts a journal that includes all the analysis of costs to branches/funds and or activities as set.

Inspection of relevant reports will show the analysis and journal details can also be seen by listing journals

The journals are posted with the appropriate accounting entries automatically when any particular payroll is finalised (Filed to HMRC or Closed if the FPS has been suppressed). For all payroll years up to 5th April 2022 the journal is an aggregate for all employees. From 6th April 2022 a journal for each employee is posted.

§