Apportionment - Using Funds, Departments and Activities

Whether using Accruals (Income and Expenditure) or Receipts and Payments method apportionment of income and/or costs occurs often in charity accounting and reporting.

Examples such as:-

- Allocation between funds

- Payments made, or receipts received for more the one fund and need to be apportioned between them

- Apportioning between charitable purpose and fundraising

- Perhaps expenses on stationary are shared between the two areas

- Allocation between charitable activities

- For example the costs of an administrator spread across a number of charitable activities

- Allocating support costs to charitable activities

- Charities reporting an accruals basis with a number of significant charitable activities are required to report a full cost for each activity. This requires costs analysed either directly related to an activity or to more general support or governance costs and then apportioned across the activities and shown in a note in the annual accounts.

The system supports apportionment by providing a number of transaction analysis tools. As transactions are entered, either via a bank statement upload or manually posted, the appropriate level of allocation can be recorded and reported.

Funds

For all charities fund accounting is mandatory. The system allows users to manage as many funds as are necessary. For more on setting up Funds go to Charity Fund Accounting

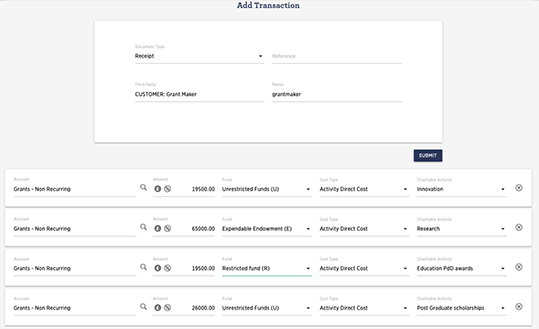

For any transaction the amounts may apportioned to the relevant funds; in this example a receipt transaction from a bank statement upload is analysed across multiple funds (as well as cost type and activity)

Departments and Activities

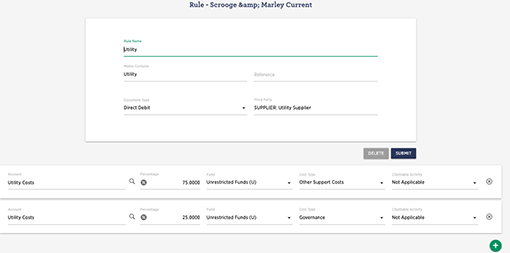

Departments is an analytical area that to which income and expenditure can be analysed and reported on. The use of Departments is activated from the Optional Features Tab of the Organisation Profile. The system uses the general term of Department but users can configure an alias if preferred. In the examples below Department has been given an alias of Cost Type. For more on setting up Departments go to Departments

Activities is an analytical area that to which income and expenditure can be analysed and reported on. The use of Activated is activated from the Optional Features Tab of the Organisation Profile. The system uses the general term of Activity but users can configure an alias if preferred. In the examples below Activity has been given an alias of Charitable Activity. For more on setting up Activities go to Activities

For any transaction the amounts may apportioned to the Departments (Cost Type) and/or Activities (Charitable Activity)in this example a expense transaction from a bank statement upload is analysed across multiple departments (Cost Type) and multiple activities (as well as Funds)

Apportionment when using the Integrated Payroll

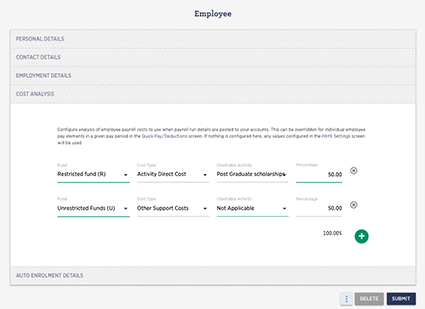

The integrated the payroll has powerful apportionment tools. employee costs be split using percentage allocations across Funds, Departments and Activities.

There are three levels at which employee costs can be allocated, in each case a Cost Analysis Tab provides access to a screen where allocations are set.

- Paye Setting

- At the top level allocations set at this level will be applied as the default if no other allocations have been set

- Employee Level

- On the employee details tab, for a particular employee, allocations can set and these will be applied when a payroll is run that includes this employee and overrides any allocation set at the PAYE level

- Payroll Run

- For a particular payroll run, the QuickPay/Deductions screen allows the cost allocations for any employee to be modified for this particular run. Subsequent payroll runs then revert.

For more on setting up payroll costing go to Payroll Costing

An example of allocations set for a particular employee is shown below

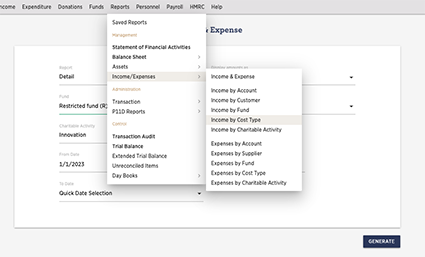

Reporting

Income and Expenditure by any of the analysis items can be run from the Reports menu.

In many cases the reporting can be layered such as Activities within a particular Department for a selected Fund etc.

Whilst the SoFA is only reportable by Fund the use of departments and activities and the reports available provide a very broad range of analytical tools to provide understanding and data for notes.